The Employee Provident Fund Organization of India (EPFO) is warning of its bankruptcy over the issue of increased outflow by the pensioners! The newspapers are reporting that, The Employees’ Provident Fund Organisation (EPFO) may find it impossible to resist attempts by subscribers to inflate their pension entitlements to levels far beyond its capacity to provide these, raising the spectre of bankruptcy and a grave risk to the monies deposited by millions of workers in the assorted schemes administered by the body. Most of the young employees are not contributing higher portions of their current salaries to their EPFO account while old pensioners are taking out pensions, according to government increments, way above their lifetime actual salaries. This is unsustainable in the long run.

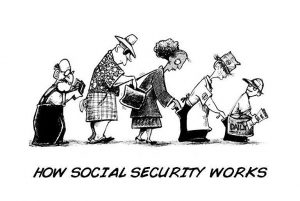

This is not surprising. This end result was always on the cards for all governmental so-called social security schemes because of their very design. Governmental social security schemes are nothing but a redistribution of income from young productive part of the population to old dependent unproductive part (see figure 1).

Social security schemes will remain viable as long as the demographic mix is favorable i.e., there are more young workers to pay for the pensions of less old retirees. In a country like India such demographic mix is shifting as the years are passing by. Just like other developed Western world countries India will also soon start to age i.e., there will be more old people than youngsters. This means disaster for all these social security schemes. The EPFO warning tells us that we will not have to wait for long for the problems to start in India. The mismanagement of funds by the EPFO combined with the shifting demographic mix means the problems will come sooner than later haunting everyone.

Like always, it turns out that government security is no security at all. As we are seeing in the Western world cities after cities and countries after countries are going bankrupt and unable to pay pensions and other social security benefits to their retiree population. India is heading in the same direction. Those who are solely relying on government social security for their retirement life are going to have a crude shock in future. Such socialist redistribution schemes always come to an end because the system can’t handle the load of so many dependent people. Prosperity can only come via productivity increases. One can only distribute something that he has first produced! There is no consumption without prior production. There are no magic tricks up the government’s sleeves to by pass this law of economic science.