With the slowing GDP, the rising prices – the retail inflation rose to its highest since Modi came to power in 2014 of level of 7.35% in December – of various goods like onion, garlic, milk etc., is raising a specter of stagflation in India. Modi government is pushing RBI, which it owns, to lower rates since growth started to slump more than a year ago. RBI’s Philips curve model guidance tells it that there is a trade-off between inflation and unemployment/growth and so they are trying to boost growth by lowering rates while risking some inflation. But to RBI’s surprise, nothing is happening to growth while price inflation has sky rocketed to multiyear high. This phenomenon in economic science is called stagflation. What explains this phenomenon of stagflation in India? Let us examine.

What is Stagflation?

The phenomenon of stagflation is characterized by the simultaneous occurrence of a strengthening in the growth momentum of prices and a decline in real economic activity (Frank Shostak, 2006).

Mainstream economics uses the Phelps-Friedman model to explain the phenomenon of stagflation. But this model is faulty because it (falsely) assumes that money printing and spending by RBI and government can lift the real GDP i.e., production of economic goods. Such money printing can never lift the real GDP; it can only reallocate resources from the wealth generating sector of the economy to the wealth consuming sector. And in that process it generates the phenomenon of stagflation as we will see below. I will advise my readers to read the above cited article of Prof. Shostak for a step by step rebuttal of Phelps-Friedman model of stagflation. In this article I want to discuss the causes of stagflation in India at present.

Causes of stagflation

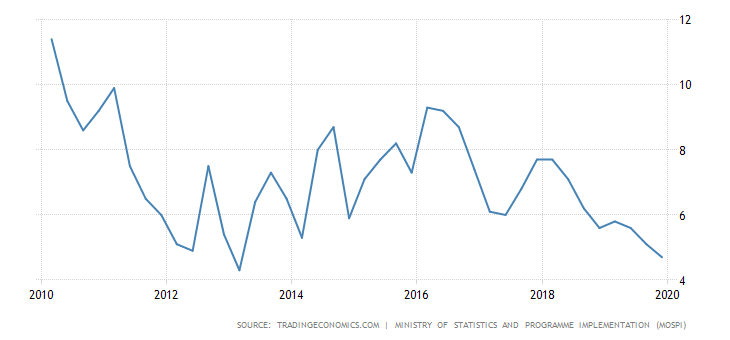

RBI, India’s central bank, is always the root cause of one bubble activity after another in the economy. Indian economy passes through boom and bust cycles periodically (see table 1 below).

Figure 1 India GDP Annual Growth Rate (Source: https://tradingeconomics.com/india/gdp-growth-annual)

RBI is a central planning monetary institution. Its governor and other monetary policy committee members determine what the monetary rate of interest in the economy will be. By doing this they try to play God because interest rate is a price of time which only all market participants can decide together via their saving and consumption decisions. Few people sitting in RBI’s headquarters in Mumbai cannot substitute the saving and consumption decisions of billions of Indians. RBI’s easy money policies, which manipulates the interest rate, throughout years have always disturbed the natural production and capital structure of the economy i.e., economy continues to produce goods that are not the most urgent needs of the consumers while millions of Indians are still living below poverty line with unfulfilled needs. This same easy money policies have also generated a huge income and wealth inequality in the country while simultaneously generating price inflation, like today, that hurts poor the most. Since assuming office a year ago the new RBI governor Shaktikanta Das, who is a history graduate and a career bureaucrat without any sound knowledge of economics, has reduced the interest rate record five times in a year. Not only this, he is also using all kinds of unconventional ways like operation twist to lower the rate of interest. Such twisting policies of RBI has really twisted the Indian economy!

When on one side RBI is busy pumping money in the economy, on the other side the Modi government is also busy hurting the economy via their muddleheaded policies like demonetization, GST, heavy taxes on telecommunication firms like Airtel and Vodafone, tax terrorism, ban on use of single use plastic to protect the climate, forced switch over to electric vehicles by 2030, raiding RBI reserves, starting antitrust cases against the online retail giants like Amazon and Flipkart, CAA, NRC and all kinds of crazy welfare schemes and spending putting rupees in the hands of people whose consumption preference is very high and on and on. All these ever changing policies and following flip-flops have generated a mammoth regime uncertainty in the economy. Businesses are not sure about the future prospects amidst these heightened uncertain economic, social and political environment in India. They are fearful. Businesses flourish the most where future is quite certain. Entrepreneurs want to safeguard their businesses and so they are reluctant in investing. Because of these, manufacturing activity is in negative. Agriculture production is going down. Production activities are on halt or in reverse gear as one bubble activity after another is bursting. Export and import both are down. This has plunged the economy into a recession.

As I have said above, to fight this recession, RBI is frantically reducing its interest rate. In last one year itself Shaktikanta Das has reduced rates five times. This pumped money has entered various sectors of the Indian market, like the stock market which is right now zooming to new all time highs, and lifting the prices of various goods one by one. The more the RBI interferes with the working of the economy, the more distortions it generates. The more Modi centrally plans the economy, the more it hurts the economy. These twin factors of rising money supply and dwindling production of real goods has generated a specter of stagflation in India.

Conclusion

Stagflation is one of many results of interventionist policies of the government and its central bank RBI. This socialist central planning guarantees these kinds of consequences. As long as RBI and government continue to fiddle with the economy, we will continue to see problems like recession, stagflation, depression and the final end of hyper-inflationary depression. The way RBI is increasing the money supply, I won’t be surprised to see India becoming the next Zimbabwe.