In today’s highly volatile world, managing one’s financial resources to remain financially and economically secure is a top priority. We are in uncertain times like never before as no one knows what the next year or month or day will bring in front of us. Who would’ve thought that year 2020 will be a roller coaster ride like how it turned out to be? Who would’ve thought that they will suddenly lose their jobs and savings under the covid-19 lock down? Within few months, many people lost their lifetimes’ earnings and lives. Who would have thought that the banks in which they are saving their nest egg will suddenly close down and refuse to give them back their own money? But all these things have happened right in front of our eyes in recent times. Individuals need to learn some lessons from these events about managing one’s finances to secure their future. In this short article I want to discuss one such investment avenue of government bonds.

Many Indians believe that investing (sic) in government bonds is the most safe and least risky way of managing one’s financial resources. This is especially true among the salaried class public. How true is this belief? Is this belief based on sound analysis of theory and history i.e., data? What are the costs and benefits of investing in government bonds? Let us see.

Benefits

The single most important benefit of government bonds cited by experts and lay people is that they are the safest and least risky. This is because people believe that no matter what happens, the government will always honor its promise and get money from anywhere to pay back its creditors. Because government has the coercive tax and money printing powers, this belief prevails among the public. The former US central bank governor Alan Greenspan on TV gave this statement:

The United States can pay any debt it has because we can always print money to do that.

Mainstream economists have also helped in creating and keeping this belief going by coining terms like government debt is not a problem because we owe it to ourselves! Nobel prize winning Keynesian school economist Paul Krugman on record has said this many times:

Globally, and for the most part even within countries, a rise in debt isn’t an indication that we’re living beyond our means, because as Fatas puts it, one person’s debt is another person’s asset; or as I equivalently put it, debt is money we owe to ourselves — an obviously true statement that, I have discovered, has the power to induce blinding rage in many people.

Costs

Now let’s scrutinize above claims against theory and history.

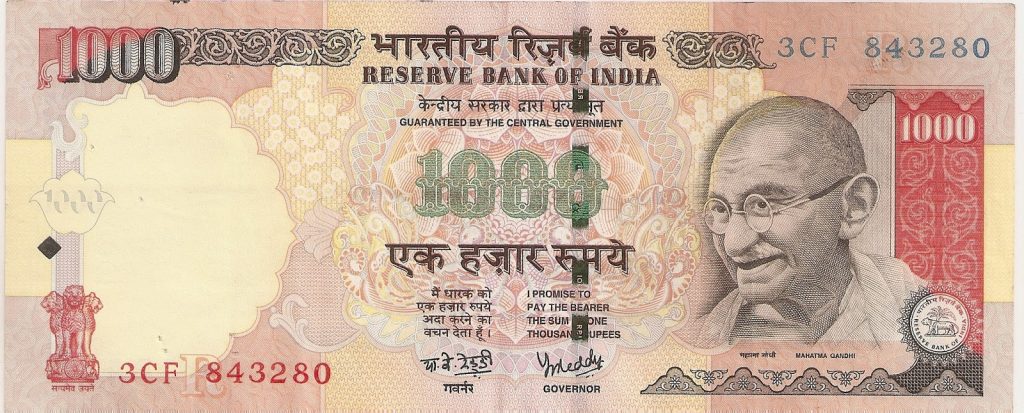

Firstly, to believe that government will always honor its promise is a false belief and just in recent history we have many examples to prove that. Take for example Modi government’s policy of demonetization where overnight India’s prime minister Narendra Modi removed 500 and 1000 rupee notes from circulation by declaring them just pieces of paper. That move was a massive breach of public trust on government. Why? Because, if one closely analyze then every RBI printed rupee note is guaranteed by the central government of India where the governor of RBI, which is 100% government owned central bank of India, promises to pay back the bearer the written amount of sum (see figure 1 below).

By overnight, without informing the public, Modi discontinued these notes and by doing that he broke peoples’ trust on government institutions. Coupled with demonetization, RBI’s inability to handle bank crises like the PMC bank or the PNB bank scam etc., shows that public cannot trust RBI also when it comes to safety of their money. Looking at this history, it will not be surprising if in future government will outright refuse to honor its debt and ask the government bond holders to take a steep haircut i.e., if government owes you 100 rupees then it will ask you to take back only 10 rupees thus by asking you to take a 90% haircut.

Also, in recent years only world over various governments have defaulted on their loans e.g., the government of Greece and Cyprus. Creditors lost a lot of money putting their trust in these governments. In USA also Detroit city municipality has defaulted on its bonds and asked creditors to take a steep haircut.

Thus, the statement of Alan Greenspan that government can always print money to pay its debt is a myth. May be the United States government can think of doing that because world debt right now is appraised in term of US dollar. But that may not remain to be the case in future as dollar is slowly losing its role of international reserve currency. Other governments can’t print money to repay their debt because other country creditors will not accept payment in local currency, and it will also very likely generate hyperinflationary price effect. And then paying back one’s debt in money that is way lower in purchasing power, due to money printing inflation and resulting higher prices, is in a way default only; it is a worst form of cheating.

Second, Paul Krugman is also wrong when he says that, government debt is not a problem because we owe it to ourselves. It is true that one person’s debt is another’s asset but only when that debt is a productive debt i.e., when the borrower will use that borrowed money in wise investment which will increase his future income so he can more than repay his debt. Government borrowing and spending is almost always 100% unproductive because government wastes resources on unproductive uses like building roads where they are not needed or starting welfare programs where money is simply consumed or for buying votes in one or other boondoggle schemes. Contrary to Krugman, government spending does not make us rich. The so-called government investment is also not investment in true sense because governments don’t know which sector needs investment and how much as it lacks the economic calculation system of price and profit and loss. The word We also hides lot of important details. It is a collective term which doesn’t exist in reality. In reality there is no one We. Any society is made of individuals and some of them are creditors and some are debtors. As we saw above, in absence of productive use of borrowed money creditors will definitely lose their investment as debtors will default on their loan. We do not owe anything to ourselves because there is no We or ourselves!

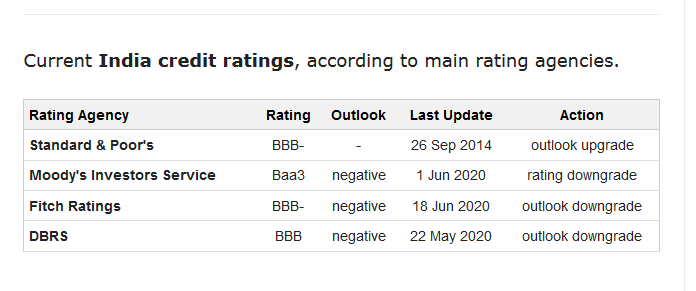

Thirdly, the safety of government bonds is actually measured by various credit rating agencies around the world. The track record of these agencies is not very stellar but nonetheless these ratings do reflect the health of government finances, especially for a country like India, in some way. Let us see the credit rating of the Indian government to assess how risky Indian government bonds are.

Figure 2 shows Indian government’s credit rating by various agencies. Almost all ratings are that of BBB level which is of lower medium grade. This rating is just above the pure speculative grade. This means, Indian government bonds have some speculative elements in them and so are highly risky! And this has been the case for last thirty to forty years as the data in above source show.

And finally, the return on investment in Indian bonds is also very low. In last five years it has been anything between 6% to 8%. If we minus inflation from this return then investors are losing their money in Indian government bonds.

Conclusion

All in all, the belief that government bonds are the most safe and least risky financial instrument is unfounded when we see the evidence. Indian government’s finances are becoming very strained during this covid-19 lock down times. No one can for sure say that the Indian government will not default. Looking at the track record of the present Indian government, trusting it will be highly risky. Government bonds are also not giving any real returns. Looking at all these, it is important for Indians to diversify their portfolio away from government bonds. In highly inflationary Indian economy one must look at other far better avenues of investment so as to protect his/her financial future. Relying too much on government will be like committing suicide.