Recent survey said 77% of Indians want petrol and diesel to come under GST. The rationale for bringing petrol and diesel under GST goes something like this,

Bringing petrol and diesel under the ambit of GST will significantly improve the cost of living for many. The price of petrol and diesel can come down to Rs 75 per litre and Rs 70 per litre with a 28 per cent GST rate. “This could give a huge impetus to the economy and businesses via increased consumer spending. However, both the center and states will see loss of revenue in the short term,” the survey notes.

There are many things that need discussion here. First, are the prices of 75 per litre for petrol and 70 per litre for diesel lower prices? Why not bring down the prices to Rs.10 per litre? Or 5 rupees or 5 paisa per litre? Isn’t that a better improvement in the cost of living of Indians? Second, is bringing petrol and diesel under GST the only way of bringing down the cost of living for many? Or are there better alternatives available? Third, will consumer spending give a huge impetus to the economy and businesses? Will center and state see loss of revenue in the short term, and is it a good or bad thing? Let us discuss all these issues one by one below.

I know many people will think I have lost my mind when I said why not bring down the price of petrol and diesel to 5 paisa per litre, but I haven’t lost my mind. Bringing down the price to that level or any other level is very much possible. It only requires political will and societal understanding of the science of sound economics. Let us see how the prices are determined in the market, in our case the price of petrol, by four economic forces which are:

- Demand for petrol

- Supply of petrol

- Demand for money I.e., rupees; and

- Supply of money

Now, if three remaining variables remain constant then increase in demand for petrol will increase the price of petrol, and decrease in demand for petrol will decrease price of petrol. Under the similar assumption of other variables remaining constant, increase in supply of petrol will decrease its price and decrease in supply of petrol will increase its price. Increase in demand for money, i.e., cash balance, will reduce price of petrol and decrease in demand for money will increase price of petrol. Similarly, and this is most important, increase in supply of money, which is inflation, will increase the price of petrol, and the price of everything else also, and decrease in supply of money will decrease the price of petrol (for a detailed discussion of this please read Murray Rothbard’s Mystery of Banking (Chapter 2-3)).

Also, government taxes increase price of petrol over and above its market price.

Worldwide supply of petrol is rising due to technological innovations, like fracking, so the price of petrol must decrease as we have seen in international prices of crude oil over a period of time (see figure 1 below).

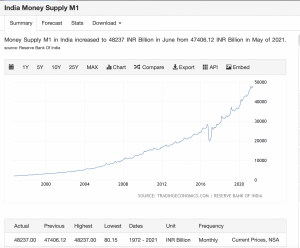

Last year demand for petrol crashed because of Covid lock downs which should have resulted in very low prices of petrol in India, but we didn’t experience those lower prices. So both demand for, and supply of, crude oil tell us that prices of petrol and diesel must fall in India, but they keep on rising. Why? The rise in price of petrol and diesel in India can only be explained by demand for and supply of money variables as well as government taxes. The single most important factor here is supply of money i.e., inflation. The supply of money in India is rising rapidly due to RBI created inflation, especially after Narendra Modi government came to power (see figure 2 below) .

Government taxes on petrol and diesel are also rising rapidly under the Modi government.

The central excise duty on petrol in 2014 was Rs 9.48 per litre. Currently, the central excise duty on petrol stands at Rs 32.9 per litre — an increase of nearly 3.5 times, data from the Union Finance Ministry showed.

This means rapidly increasing money supply and government taxes are responsible for the continuous rise in prices of petrol and diesel in India. The government (especially Narendra Modi government), and its central bank RBI are solely responsible.

Looking at the international scenario of supply of and demand for crude oil, the prices of petrol and diesel would have come down rapidly in India if the Indian central bank RBI was not creating inflation and Indian government was not imposing heavy taxes on petrol and diesel. Bringing down the prices of petrol and diesel to 5 rupees per litre or 5 paisa per litre is very much possible if we stop RBI from printing rupees and generating inflation, as well if we can pressure government to abolish the taxation, especially on petrol and diesel in this case. Instead of bringing petrol and diesel under GST, we should abolish all taxes on petrol and diesel to bring down the cost of living for all Indians rapidly. Including petrol and diesel under GST is not an optimum solution of bringing down our cost of living. Abolishing RBI’s inflation and government taxes is the optimum solution. But there is no political will to carry out these changes, and the voting public is ignorant of sound economics so they are never going to pressure the government to do the right thing.

Consumer spending bringing both the economy and businesses out of recession is a fallacy that I have exposed in my past articles so I do not feel the need to discuss that issue here again. Suffice it to say that consumer spending is not the driver of the economy, saving, and investment is. Increasing consumption will only make us poorer in the future. It will only deepen recession.

As far as finances of the government are concerned, sound economics tells us that government at the least must balance its budget by reducing its spending without trying to increase its revenue. That means reduction in government revenue is a good thing for the economy. If abolishing taxation reduces government revenue then so be it. Government’s size must reduce if India is to progress.

Conclusion

If the objective is to bring down the cost of living for Indians then best solution is to stop the RBI from generating inflation and abolish government taxes. Bringing petrol and diesel under GST will not help much. Rs.75 per litre price of petrol is still very high. And by reducing the price of petrol and diesel, whatever money consumers are going to be left with is better saved and invested to build human and physical capital which can increase future production and income. If that increased income is going to go into consumption then that will result in lower future income. Government’s lower revenue is not a cause for worry. A reduced size of government is to be celebrated and not mourned.

I am still confused as to how GST will reduce the price of petrol and diesel? I go to a restaurant and I have to still pay this state and central GST which is extra money for the meal I ordered. Taxation increases prices, not decrease it, period, from what I know. Could you point out how GST decreases prices of petrol and diesel? Or is it just political clout?

It reduces from its current level of 100 rs/ltr. Base price, without any taxes, today is something like 40 rupees. 60 rupees is tax which is more than 100% tax rate. GST will remove all taxes and only 28% top rate will apply so prices will come down from their present high level. GST is like lesser evil option.

But I showed in my article much better alternative is available. GST isn’t a solution.

Okay, so the current taxes are more than GST. That makes sense.

Okay, so the current taxes are more than GST. That makes sense.