Recently RBI released the inflation numbers and they don’t look good for the Modi government which is getting ready for elections in 2024. Retail inflation hit a high of 7.8 percent in April while wholesale inflation crossed 15% mark. This high level of price inflation coupled with so many other economic, social, religious etc., issues can topple the Modi government. Recently losing elections in the state of Karnataka has put the Modi government in some trouble.

Worried about the prospect of losing power, the central government in Delhi has taken series of temporary steps to cool down inflation. Are these steps going to address the problem of inflation? To understand the answer we need a quick lesson in monetary economics.

First, what is inflation? To eliminate any problem we need to understand it, and to understand any problem we need to define it properly.

Modern mainstream economists define inflation as a sustained increase in the general price level. But the idea of a general price level is a myth. What they call a “general price level” is not general at all, and the way they measure it makes this point clear. By definition the general price level must include all prices prevailing in an economy, but no such calculation takes place. Instead, mainstream economists take into consideration only some arbitrarily chosen prices collected from the wholesale and retail market. The price indexes – WPI and CPI – construct what they call the general price level. Clearly these indexes do not reflect the real picture of the inflation problem in the economy.

Opposing the modern definition of inflation, historically inflation was always defined as an increase in the quantity of money and credit. Defining inflation by using prices is a very disingenuous effort of governments and their court economists to divert the attention of the gullible public from the cause of inflation to its effects. As Henry Hazlitt said, for this increase in the quantity of money and credit the central bankers are solely responsible because in our modern times central bankers have the monopoly control over the issuance of currency notes. This increase in the quantity of money and credit in turn have three chief consequences. First, as the Cantillon effect informs us, as freshly printed money enters the market from one sector to another it slowly lifts the prices in those sectors respectively. Second, the same Cantillon effect also tells us how central bank money printing generates income and wealth inequality. Those who receive the freshly printed rupees first – usually politicians and their friends – benefit from it while those receiving money later are harmed by it. Third, the manipulation of the monetary rate of interest by the central bank creates an imbalance between the monetary rate of interest and the originary rate of interest (which is determined by the societal time preference), and this in turn generates the famous trade/business cycles.

Under the light of these sound economic doctrines we can now analyze Modi government’s efforts to cool down inflation.

Below are the policy measures that Modi government has taken to cool inflation as reported by the newspaper Economic Times.

1. The government announced an excise tax cut of Rs 8 per liter on petrol and Rs 6 per liter on diesel. The government will bear a shortfall of Rs 1 lakh crore due to the excise duty cut on petrol and diesel.

2. Taking a cue from Centre, three states – Kerala, Rajasthan, and Maharashtra – also announced reduction in state taxes. The reduction in pump prices of petrol and diesel will bring down the logistics cost for the industry.

3. The government also reduced the import duty on key raw materials and inputs for the steel and plastic industry.

4. The government has levied export duty on some steel products and raised it on iron ore and concentrates. Together with the import duty cut, the price of steel will come down.

5. During the current and next financial year, the government has permitted duty-free imports of 20 lakh tonnes of crude soybean and crude sunflower oil.

6. Under the Ujjwala Yojana, the government has also granted a Rs 200 per cylinder subsidy. This will benefit around nine crore beneficiaries.

7. The government set a limit of 100 lakh tonnes on sugar exports to ensure that there is adequate stock when the sugar season begins in October to cover three months’ worth of consumption.

8. The Centre has also regulated sugar exports to maintain adequate stocks in the country. From June 1, only 10 million tonnes of sugar can be exported in the current marketing year which ends in September.

9. India slapped a ban on wheat exports to maintain food security and cool prices.

10. Over and above Rs 1 lakh crore budgeted for the current fiscal, the government will provide an additional fertilizer subsidy of Rs 1.1 lakh crore to farmers.

None of the steps taken by the Modi government address the inflation problem because they don’t stop the RBI from printing more rupees. Cutting taxes, giving subsidies, and halting export etc., might give an appearance of lower prices of some products (which are mainly sensitive to the voters) for a while but as long as RBI keeps pumping more money into the economy, inflation continues unabated.

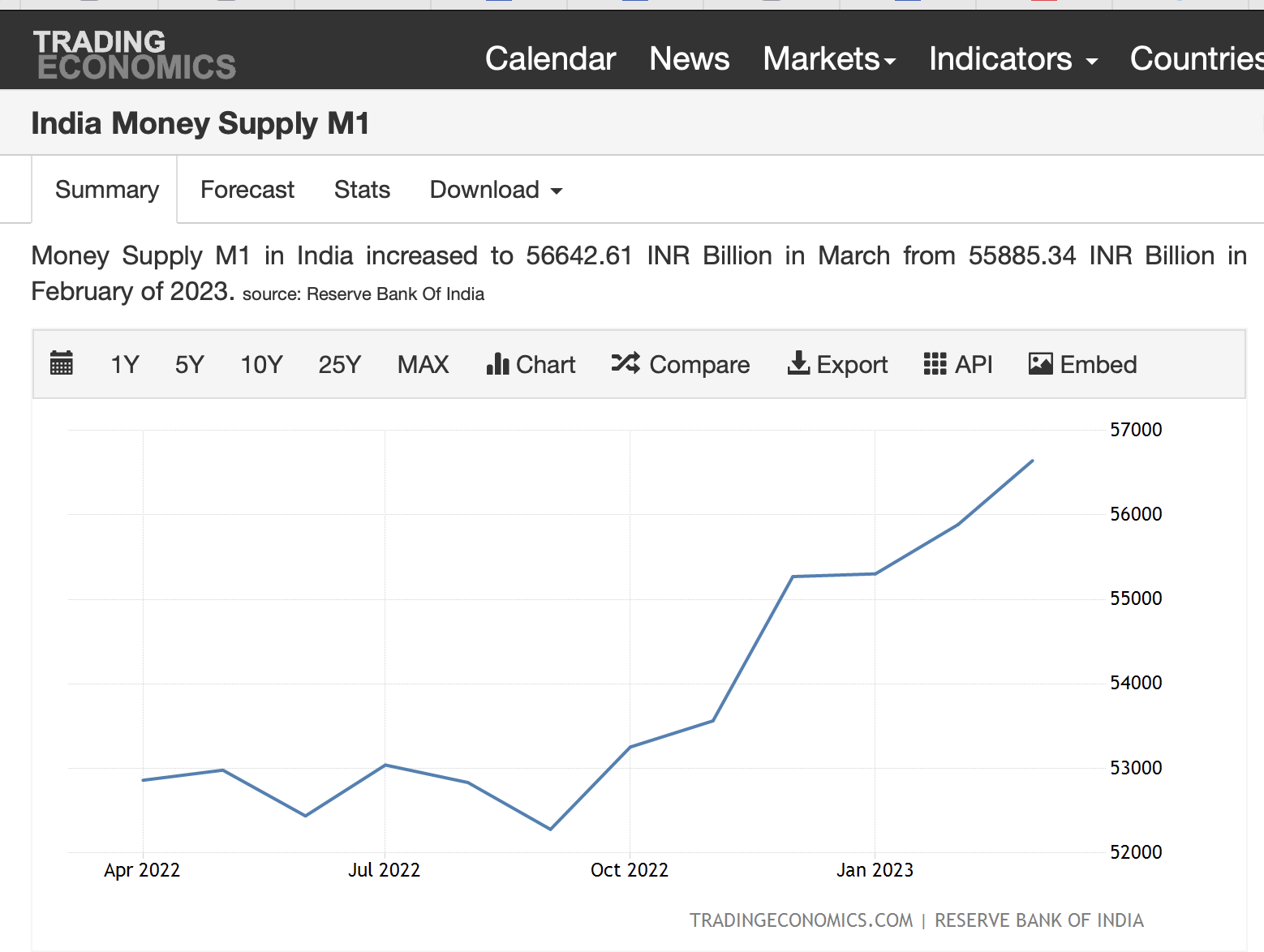

Even in the language of mainstream court economists these steps do not bring down prices economy wide. They only tinker with some of the prices. For economy wide prices to come down the purchasing power of rupee must go up, and for that the RBI must either immediately stop printing fresh rupees or contract the money supply quickly. So far RBI is doing neither of those two things. The money supply M1 (currency with the public and demand deposits with banks) was still rising in the month of March according to data provided by the RBI (See figure 1 below).

All in all, those steps announced by the government will only create a short term mirage of lower prices. They do not address the core problem of inflation. Giving subsidies and messing with exports will only have unseen detrimental effects on the economy, which we will not discuss here. As we all know, the facade of fighting inflation is to fool the voting public into thinking that government is doing something to better their lives. Once the elections will be over next year, prices will jump up even higher than what they are today.

Recently, I have become interested in political and economic affairs in India and, in future, this blog in the spirit of Austrian economics will become a welcomed resource of sound analysis.

And, it is always good to see R. Cantillon and H. Hazlitt get a shout-out.

Many thanks!

Thanks for subscribing.

Didn’t knew we have a Mises India website as well. Good article btw, but it is hopeless I feel because Austrian economics is way beyond our juncture in current times politics of subsidies and Revdi.